Advertisement

-

Published Date

October 5, 2021This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

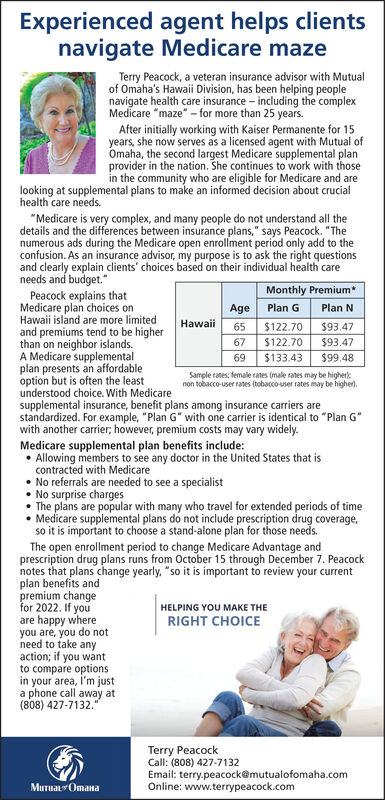

Experienced agent helps clients navigate Medicare maze Terry Peacock, a veteran insurance advisor with Mutual of Omaha's Hawaii Division, has been helping people navigate health care insurance including the complex Medicare "maze" - for more than 25 years. After initially working with Kaiser Permanente for 15 years, she now serves as a licensed agent with Mutual of Omaha, the second largest Medicare supplemental plan provider in the nation. She continues to work with those in the community who are eligible for Medicare and are looking at supplemental plans to make an informed decision about crucial health care needs. "Medicare is very complex, and many people do not understand all the details and the differences between insurance plans," says Peacock. "The numerous ads during the Medicare open enrollment period only add to the confusion. As an insurance advisor, my purpose is to ask the right questions and clearly explain clients' choices based on their individual health care needs and budget." Monthly Premium Peacock explains that Medicare plan choices on Hawaii island are more limited and premiums tend to be higher than on neighbor islands. A Medicare supplemental plan presents an affordable option but is often the least understood choice. With Medicare Age Plan G Plan N Hawaii 65 $122.70 $93.47 67 $122.70 $93.47 69 $133.43 $99.48 Sample rates; female rates (male rates may be higher): non tobacco-user rates (tobacco user rates may be higher). supplemental insurance, benefit plans among insurance carriers are standardized. For example, "Plan G" with one carrier is identical to "Plan G" with another carrier; however, premium costs may vary widely. Medicare supplemental plan benefits include: Allowing members to see any doctor in the United States that is contracted with Medicare No referrals are needed to see a specialist No surprise charges The plans are popular with many who travel for extended periods of time Medicare supplemental plans do not include prescription drug coverage, so it is important to choose a stand-alone plan for those needs. The open enrollment period to change Medicare Advantage and prescription drug plans runs from October 15 through December 7. Peacock notes that plans change yearly, "so it is important to review your current plan benefits and premium change for 2022. If you are happy where you are, you do not need to take any action; if you want to compare options in your area, l'm just a phone call away at (808) 427-7132. HELPING YOU MAKE THE RIGHT CHOICE Terry Peacock Call: (808) 427-7132 Email: terry.peacock@mutualofomaha.com Online: www.terrypeacock.com MuTuaLOmana Experienced agent helps clients navigate Medicare maze Terry Peacock, a veteran insurance advisor with Mutual of Omaha's Hawaii Division, has been helping people navigate health care insurance including the complex Medicare "maze" - for more than 25 years. After initially working with Kaiser Permanente for 15 years, she now serves as a licensed agent with Mutual of Omaha, the second largest Medicare supplemental plan provider in the nation. She continues to work with those in the community who are eligible for Medicare and are looking at supplemental plans to make an informed decision about crucial health care needs. "Medicare is very complex, and many people do not understand all the details and the differences between insurance plans," says Peacock. "The numerous ads during the Medicare open enrollment period only add to the confusion. As an insurance advisor, my purpose is to ask the right questions and clearly explain clients' choices based on their individual health care needs and budget." Monthly Premium Peacock explains that Medicare plan choices on Hawaii island are more limited and premiums tend to be higher than on neighbor islands. A Medicare supplemental plan presents an affordable option but is often the least understood choice. With Medicare Age Plan G Plan N Hawaii 65 $122.70 $93.47 67 $122.70 $93.47 69 $133.43 $99.48 Sample rates; female rates (male rates may be higher): non tobacco-user rates (tobacco user rates may be higher). supplemental insurance, benefit plans among insurance carriers are standardized. For example, "Plan G" with one carrier is identical to "Plan G" with another carrier; however, premium costs may vary widely. Medicare supplemental plan benefits include: Allowing members to see any doctor in the United States that is contracted with Medicare No referrals are needed to see a specialist No surprise charges The plans are popular with many who travel for extended periods of time Medicare supplemental plans do not include prescription drug coverage, so it is important to choose a stand-alone plan for those needs. The open enrollment period to change Medicare Advantage and prescription drug plans runs from October 15 through December 7. Peacock notes that plans change yearly, "so it is important to review your current plan benefits and premium change for 2022. If you are happy where you are, you do not need to take any action; if you want to compare options in your area, l'm just a phone call away at (808) 427-7132. HELPING YOU MAKE THE RIGHT CHOICE Terry Peacock Call: (808) 427-7132 Email: terry.peacock@mutualofomaha.com Online: www.terrypeacock.com MuTuaLOmana